netWell Healthshare in Colorado

Health Care Cost Sharing Plans to Fit Your Lifestyle!

Reviewed by Leslie Jablonski – Fact checked by Christine Corsini

Colorado residents have a compelling alternative to the high cost of health insurance: netWell Healthshare, one of Colorado’s leading healthsharing membership plans is netWell.

Healthsharing organizations like netWell offer families and small businesses all over Colorado a way to voluntarily share the medical expenses of like-minded people who share your values.

Note that healthsharing and health insurance are two distinct things. netWell is NOT health insurance. Instead, netWell is a voluntary association of like-minded people who agree to share one another’s medical bills.

What Is Health Care Cost Sharing (Health Sharing?)

Health sharing plans are a low-cost alternative to ‘traditional’ health insurance approaches.

These innovative, independent health organizations have been tremendously popular in Colorado, and typically provide significant cost savings compared to the unsubsidized costs of Affordable Care Act-qualified health insurance plans available over the Covered Colorado health insurance exchange website.

Healthsharing organizations give their members an opportunity to share medical costs with other members of the community. Many healthshare organizations are faith-based, though not all of them.

Who Is Health Sharing For?

Healthshare plans are not a great match for everybody.

For example, unlike traditional health insurance plans, which must provide coverage for pre-existing conditions immediately, healthsharing plans can and do typically impose a waiting period before bills related to pre-existing conditions become fully shareable.

Also, healthsharing plans do not qualify for a subsidy under the Affordable Care Act.

So if you are in a health insurance open enrollment period and you have significant pre-existing conditions or qualify for a substantial health insurance subsidy, you may be better off choosing an Affordable Care Act-qualified traditional health insurance plan.

But if you don’t qualify for subsidies, you may find that joining a healthshare program provides financial benefits that can’t be ignored. The cost savings are so significant that many of our clients who qualify for a partial subsidy have still found it to be a better value than a Connect for Health Colorado health insurance policy.

Why Get netWell Healthshare in Colorado?

Click here to read netWell Advantage Comprehensive Member Guide.

Here’s why Colorado residents should consider netWell as a viable, money-saving healthsharing alternative to traditional health insurance.

netWell Affordability

netWell HealthShare offers affordable monthly contributions, which are typically just a fraction of the cost of traditional health insurance premiums without a significant Affordable Care Act subsidy.

No network restrictions

Unlike most traditional health insurance plans, netWell does not have any network restrictions. Members can seek care from any provider they choose – even in Colorado’s sparsely populated Western Slope communities.

Shared responsibility

netWell HealthShare operates on the principle of shared responsibility, where members share the cost of medical expenses. This promotes a sense of community and accountability among members.

How Does netWell Health Sharing in Colorado Work?

Here’s how netWell Healthshare works in Colorado in a nutshell:

Members pay a monthly contribution. netWell members pay a monthly contribution, which is typically about 40 to 50% less than the cost of an unsubsidized Affordable Care Act-qualified insurance policy.

Your monthly contribution amount will vary depending on your age, family size, chosen plan, and the initial unshared amount you select.

Medical expenses are shared: If you have a need, netWell will share the cost of the bill with the thousands of other like minded members both in Colorado and nationwide who have also contributed to the sharing pool.

Note: limits and restrictions apply. For example, pre-existing conditions may have a waiting period before bills related to them are fully eligible for sharing. And there are limits on how much can be shared for certain types of medical expenses.

Members have flexibility in choosing healthcare providers: Unlike traditional health insurance HMOs and PPOs, netWell allows you the freedom to choose your own healthcare providers and hospitals. There are no network restrictions, and you can use your netWell benefits with any provider.

Members are encouraged to live a healthy lifestyle: netWell promotes healthy living by offering wellness programs and incentives to members who make healthy lifestyle choices.

netWell Healthshare Membership Plan Tiers

netWell Advantage: The Catastrophic Option

The netWell Advantage plan is designed for Colorado residents who want to focus their plan against large unexpected healthcare costs, like sudden accidents or hospitalizations.

The Catastrophic option features a very low monthly minimum contribution requirement, but provides limited benefits for routine, day-to-day doctor visits.

The Advantage plan includes free 24/7 telemedicine support, but does provide the full range of preventive care or primary care options that come with the upper-level plans.

Many people combine a catastrophic healthsharing membership plan like netWell’s Advantage plan with a Direct Primary Care membership plan that provides as many telemedicine or in-person visits with a primary care physician as you need for an affordable flat monthly fee. No deductibles, co-pays, or coinsurance required.

netWell Elite: The All-Inclusive Option

The netWell Elite plan provides Colorado residents with much more comprehensive sharing options compared to the Advantage option.

Elite plans have a higher monthly contribution requirement, but also a higher annual sharing limit ($1,000,000) and a lower Member Commitment Portion (as low as $2,500).

The netWell Elite plan also comes with additional sharing for maternity care, something very few other healthshare plans offer.

How To Join netWell Healthshare in Colorado

Joining netWell is very easy. In fact, you can enroll yourself and your whole family online in just minutes!

And there’s never any open enrollment period to worry about. You can enroll in netWell at any time during the year.

There are two paths forward. The first is to enroll yourself and your family directly, online. As we mentioned, this process is very easy, and takes just a few minutes to complete.

If you have some questions or would like some help with the process, just schedule a time to talk to one of our experienced Personal Benefits Managers.

netWell Easy Online Enrollment – Self-Service – Step by Step

Step 2: Create a netWell account. You’ll need to enter your name, email address, and a password. You can use the automatically-generated ‘strong password,’ which is virtually impossible to hack, or you can input your own.

Step 3. Check your email for verification. You may have to check your spam filter.

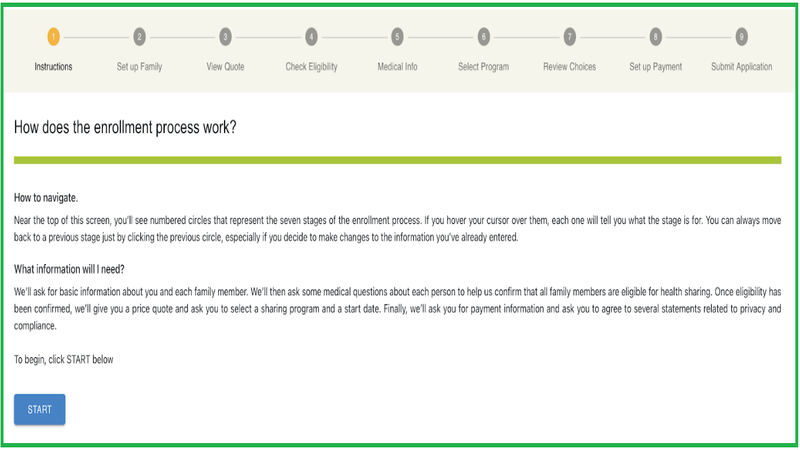

Step 4. Enter your emailed verification code into the prompt and click through. You’ll be taken to the general enrollment page, which looks like this:

Read the directions and click the blue START button.

Step 5. Enter your name, gender at birth, date of birth, and Zip code. Click “Save and proceed.”

Step 6: If you have additional family members, click the blue “+” button in the lower right hand side of the window. If you are only inputting one person, go to Step 7.

Step 7. Click “Save and Proceed.” You’ll be taken to the “View Quote” menu.

Step 8. Choose your netWell healthsharing plan. The biggest decision you’ll have is choosing your Member Commitment Portion. This is the amount you will have to pay out of pocket each year before your medical expenses become shareable under the plan. netWell offers two basic plan tiers: Elite + and Advantage. The Elite + plans have a higher monthly contribution. But they also have higher annual cost sharing and higher lifetime cost sharing limits.

8.a. Choose your Member Commitment Portion. You can choose an MCP of $2,500, $5,000, or $10,000. The higher your MCP, the lower your monthly health sharing contribution will be.

8.b. Choose a maximum sharing limit per year option. You can select either $250,000 (Advantage) or $1 million (Elite +)

8.c. Choose a lifetime sharing limit. You can choose a lifetime limit of $500,000 (Advantage) or $1 million (Elite +).

At the bottom of the table, you’ll see the monthly contribution amount for each of the available plans, so you can select the best plan that fits your budget.

Note that there’s a small nonrefundable application fee, and a monthly family membership fee listed at bottom right. That’s in additiion to your plan monthly contributions.

At the bottom left, you can click the buttons to read a brief fact sheet outlining the basic elements of the Elite + and Advantage plans.

Step 9: If you are not using an agent and enrolling yourself, click “proceed.” If you are using a ColoHealth Personal Benefits Manager to enroll, then click “Send Quote” and your PBM will get back to you to help you finalize your selection and enroll.

If you prefer to self-enroll, go on to Step 10.

Step 10: Click “PROCEED” at the bottom of the screen. You’ll be taken to the “Verify Eligibility” section. Answer the health questions by clicking either the “yes” or “no” buttons.” Keep answering the questions via the “yes” or “no” radial buttons, and clicking “Next.”

Repeat the process until all questions are answered. Then click “Proceed.” You’ll be taken to the section called “Medical Info.”

Step 11: Enter your height and weight information. Click “Next.”

Step 12: Continue to answer medical questions using the “yes” or “no” radial buttons. Keep clicking “Next” until complete.

Step 13: Select your desired language, and click “Continue.” You’ll be taken to the “Member Enrollment section.

Step 14: Select your plan name from Step 8 in the dropdown menu. Then select your desired effective date from the next dropdown menu below.

Step 15: Verify your monthly family contribution at the lower right hand corner of the table.

Step 16: Click “Select Program.” You’ll be taken to the “review choices” page.

Step 17: Verify that your personal info and plan information is correct. If something is incorrect, edit the appropriate choices. When all is correct, click “proceed.”

Step 18: Set up your payment information. Input your banking or credit card information as desired. That’s the account netWell will use to debit your monthly membership information, a one-time non-refundable application fee, and a monthly family membership fee.

Step 19: Click “continue.” You’ll be taken to the “Submit Application” part.

Step 20: Verify that all information is correct, and then click “Submit Application.”

That’s it!

If you have pre-existing conditions, you may not be eligible for immediate membership. Or your netWell plan may impose a waiting period before your healthcare costs related to treating pre-existing conditions become shareable.

Enrollment Path 2: Talk a Personal Benefits Manager

Need help deciding? That’s where one of our professional Personal Benefits Managers can help.

Your Personal Benefits Manager can help you find out whether healthsharing is a good choice for you, and which plan might be the best fit.

Your Personal Benefits Manager can also help walk you through more advanced planning areas, such as combining your netWell healthsharing plan with a Direct Primary Care membership.

To get expert, personalized assistance, click here to make a free, no-obligation appointment with a Personal Benefits Manager

FAQs About netWell Healthshare in Colorado

Does netWell include a prescription drug benefit?

Does netWell include a prescription drug benefit?

netWell is not insurance and does not include a traditional prescription drug insurance component. Instead, the company offers deep discounts on more than 600 commonly-prescribed prescription drugs through the netWellRx discount program.

Here’s how it works:

- Search for your medication. You can look up your medication on the netWellRx website or app to find out what the discounted price will be at participating pharmacies.

- Pick the local pharmacy that provides the best price.

- Show your netWellRx discount card to the pharmacist. You can either print out your NetWellRx card or show it on your smartphone at a participating pharmacy to receive the discounted price.

- Pay the discounted price: The pharmacist will apply the discount to the member’s prescription, resulting in a lower out-of-pocket cost.

It’s common for netWellRx members to save as much as 70% or more on prescription drugs by using their discount plans compared to the retail price of these drugs.

What maternity benefits does netWell provide?

What maternity benefits does netWell provide?

Under netWell’s Elite+ membership tier, pregnancy and delivery costs for normal and C-section deliveries are fully sharable up to $15,000, provided the member’s effective membership date precedes conception by at least six months.

There’s no member commitment portion for maternity costs. netWell’s sharing community begins sharing maternity and childbirth costs with the first dollar.

If there are life-threatening complications from your pregnancy or childbirth, your costs are sharable up to a maximum of $100,000.

Also, both the husband and wife must be members in the same plan. No maternity costs are shareable unless both the husband and wife are netWell plan members.

When Can I Sign Up for netWell?

When Can I Sign Up for netWell?

Unlike traditional health insurance plans, which impose a limited open enrollment period on applicants, you can enroll in netWell at any time.

Does netWell include mental health benefits?

Does netWell include mental health benefits?

The Advantage plan does not cover outpatient mental health benefits.

However, all netWell members, including Advantage members, enjoy free telephone visits with qualified masters’ level mental health counselors and therapists for urgent, emergency, and crisis situations.

These counselors are available 24 hours a day, 7-days a week, at no additional cost to the netWell member.

The Elite and Elite+ membership tiers, however, do provide excellent mental health benefits compared to most competing healthshare organizations:

netWell will share up to $40 of the $130 visit fee for up to 8 sessions per family, using the excellent eHome Counseling Services. This program includes access to the Mooditude App, which provides personalized mental health help right to your phone.

The service helps members get personalized, daily, interactive behavioral health assistance with exercises, media, videos to help members manage things like PTSD symptoms, addiction cravings, anxiety, depression, and much more.

In addition to the programs listed above, netWell’s Elite + program also lets you choose your own therapist.

However, the Elite-tier membership includes up to eight visits with your chosen counselor or therapist. The plan will share up to $40 per visit per family per year. You will be responsible for the rest.

I smoke. Can I still join netWell?

Yes. netWell is an excellent choice for smokers, because of the plan’s robust set of benefits and affordable costs. However, smokers who join netWell must pay an additional surcharge of $40 per month.

However, unlike some other health sharing plans, netWell allows smokers the same $1 million sharing cap over a lifetime as other non-smoking members. Most other healthshares sharply limit sharing maximums, especially for smoking-related illnesses.

Health Insurance Instant Quote

COLORADO HEALTH INSURANCE INFORMATION

- Plans approved and authorized under the Affordable Care Act

- Covers Pre-Existing conditions

- Low cost subsidized plans available to those earning

< 400% of the federal poverty level - Unlimited lifetime benefits

- Available during open enrollment (November 1 – January 15), or if you qualify for a Special Enrollment Period

Healthshare Instant Quote

HEALTH COST-SHARING INFORMATION

- Not Colorado health insurance, but a way for like-minded individuals to share medical expenses

- Waiting periods on pre-existing conditions

- May exclude sharing for certain conditions or activities

- Enroll any time

- Much lower monthly cost than unsubsidized health insurance

netWell Healthshare Reviews

Note: Your email will not be displayed - for verification purposes only

Affordable Healthcare Option

netWell is much cheaper than my old insurance. Yet, I still get the care I need without the red tape. It’s been a great decision.

Best decision ever!

I’m very impressed with NetWell. The customer service is excellent, and the plan fits my budget perfectly. I love the simplicity of the program and how much I’ve been able to save on my medical expenses.

Could be better

I like the concept behind NetWell, but the execution can be hit or miss. It’s affordable, but I’ve had to chase them for updates on claims, and not all medical expenses are eligible for sharing.

NetWell has been a fantastic healthcare alternative for my family

We’ve saved so much compared to traditional insurance, and the process is easy to navigate. Highly recommend!

Doesn't seem worth it!

NetWell sounded great at first, but the lack of coverage for preventive care and the slow claim processing has been frustrating. It feels like I’m paying less upfront but dealing with more hassles down the road.

Great Service, Some Room for Improvement

I’ve been a Netwell customer for a few months now, and overall, I’m pretty pleased with their health share plan. The customer service has been responsive and helpful, addressing my queries promptly. The coverage is decent, and I appreciate the cost savings compared to traditional insurance.

However, there’s still some room for improvement. The online portal could be more user-friendly, and there were a few instances where the billing information wasn’t as transparent as I’d like.

Don't do it

My son broke both bones in his arm and so far I am out of pocket $28,200 and counting he needed emergency surgery and the only thing they helped with was the ER no help with the required emergency surgery!

Satisfied but Not Wow

Netwell has been a reliable choice for our family’s health share plan. The application process was straightforward, and we’ve had no major issues with claims or coverage. The network of healthcare providers is extensive, ensuring we have options in Colorado. Though I think they should add additional wellness programs or some innovative features that would set Netwell apart. It’s good but not outstanding, and a bit more could make it great.

SCAM: Avoid at all costs

Netwell has single-handedly ensured my wife and I’s first pregnancy has been as stressful as possible, and I beg anyone who is considering using Netwell to look into ANY other options. I’m writing this review as a last resort, after countless hours on the phone and months trying to get any meaningful information or update from Netwell that isn’t an empty “We’ll expedite this and call you back” promise.

My wife and I joined Netwell months before trying for a baby. We were accepted, but had no need to use them for anything at the time. When she got pregnant, we read all of Netwell’s documentation regarding pregnancy coverage. We first had to prove to Netwell she was actually pregnant (and didn’t get pregnant before we joined the program). No problem: We visited a doctor, who sent all the necessary paperwork to Netwell.

That sat with them for months “in review.” In the meantime, pregnancy bills began to stack up. But the Netwell documentation clearly states that you cannot submit pregnancy-related claims until you’ve been approved by Netwell, so we waited.

Eventually, we called. In what would become a theme, we were told it was still in review. So we waited some more, and had more expenses pile up. After many phone calls, we got someone to look at it and approve it. Great!

We submitted the outstanding claims to Netwell, but they were denied because too much time had passed between the charge and the submission. The only reason we waited was because we were specifically told that we could not submit until they verified the pregnancy, and they took months to do what was a 3-minute review of paperwork.

After much back and forth, we were told to go ahead and resubmit the claims. We did, and then we asked about the Maternity Specialist who would act as a go-between for Netwell and the various health providers (doctors, midwives, etc) that we work with. Netwell’s pregnancy documentation specifically mentions that members will be assigned one as soon as pregnancy is verified, and that everything must go through this person. The Netwell representative said she had no idea what we were talking about, so we pointed her to her documentation. This was news to her, and she said Netwell does not assign Maternity Specialists.

Okay, fine, we’ll do it on our own. No problem. We waited for our claims to be reviewed for weeks and weeks, and made many calls. Finally we got a letter in the mail stating that everything had been rejected with no further explanation. We called only to find out they didn’t have some of the information they wanted. Rather than let us know they needed more information, they simply rejected the claims outright.

They recommended we submit our claims via email because the submission form on their website isn’t comprehensive enough for the information they need. We did that. We attached every imaginable piece of paperwork and then some.

It’s been in review for months now. First, they tried to tell us it was because they were trying to contact our providers to get additional information. We reached out to our providers, who confirmed they’ve never received any communication from Netwell at all.

Now it’s just in perpetual review. It’s supposedly been escalated a half dozen times, but every time we call we get the same story: It’s in review. Everything we submitted is well beyond their 90-day policy now and, even though every single of our claim items clearly falls into things they cover, I’m becoming increasingly certain they’re going to use length of time as the excuse for the reason they reject it all.

We’ve tried time and time again to speak to a supervisor, but a supervisor is never available. We’ve been told a dozen times a supervisor will call us back, but over the many months we’ve been battling this, we’ve never spoken to a single supervisor.

My wife now desperately needs an iron infusion for the health of her and the baby. I called to see if they would be covered. They said it would, but we MUST submit something for them to review and approve before we get the infusion or they’ll reject it outright.

They haven’t reviewed our paperwork from 3+ months ago, and we’re told we have to submit something new for them to review before she gets an infusion she needs? That could take months. Obviously we’re not waiting, and are going to pay out of pocket and just hope for the best with Netwell.

But this whole thing has just been a nightmare. If anyone is considering Netwell, I beg of you: Look elsewhere. Look anywhere else. You’re better off paying out of pocket. It’s looking like that’s what we’re going to end up doing anyway.

Good Start, Looking for More

Netwell has been a good start for our family’s health sharing needs. The application process was smooth, and the customer service has been helpful. We’ve experienced some savings compared to traditional insurance, and the coverage in Colorado is adequate. However, as a consumer in my mid-40s, I’m looking for more comprehensive wellness programs or added benefits. If Netwell could enhance these aspects, it would be a strong contender for a higher rating in the future.

Average Experience, Room for Improvement

I recently purchased a health share plan from Netwell, and while the overall experience has been satisfactory, there are areas that could use enhancement. The customer service, although responsive, lacked a personal touch that I expected when dealing with healthcare matters for my family. Additionally, the plan details were a bit convoluted, making it challenging to understand the coverage fully.

Solid Option, but Limited Mental Health Services

NetWell has been a great option for me as a freelancer. The prices are reasonable, and the coverage is solid. I do wish that they offered more options for mental health services, but that’s a minor complaint.

A Great Health Plan!

I’ve been a Colorado member of NetWell for over two years now, and I couldn’t be happier. Their customer service is top-notch, and I’ve never had any issues with getting my claims processed quickly and accurately. If you’re in the market for health insurance, definitely give them a try!

Solid Option, but Limited Mental Health Services

NetWell has been a great option for me as a freelancer. The prices are reasonable, and the coverage is solid. I do wish that they offered more options for mental health services, but that’s a minor complaint.

Affordable Coverage with Exceptional Service!

NetWell has been an absolute godsend for me and my family. The prices are incredibly affordable, and the coverage is comprehensive. We save hundreds of dollars a month compared to what we were paying to Cigna before.

Plus, the NetWell staff is always friendly and helpful. I can’t recommend them highly enough!