The ColoHealth Health & Wealth Newsletter

March 2021

Vol. 24, Issue 3

Understanding Tax-Deferred Investment Tools

Turns Out, Your Money Grows A Lot Faster When You’re Paying Less Taxes

Saving for retirement is about a lot more than throwing your money in a savings account and hoping for the best. Your retirement needs and dreams are not going to be fulfilled without some careful strategizing. Fortunately, that happens to be what we’re best at.

This month, we’re taking a look at the different tax-deferred investment tools that are available. These include 401(k)s, IRAs, and the lesser-known (but highly valuable) Health Savings Account (HSA).

While these accounts differ in a lot of ways, their end goal is the same: To maximize your earnings while minimizing tax liability.

Why is tax-deferred better?

The advantage of a tax-deferred account is pretty clear. You get to postpone the taxes on any earnings that your account generated. This means that your investment portfolio returns will be larger and larger, and the gains will compound over time.

The result is higher long-term returns, or quite simply, more money to spend in retirement. That means better health, better vacations, and the peace of mind that you’re truly set for life.

But here’s the trick: The earlier you get your tax-deferred accounts in order, the more money they’re going to make.

Is tax-deferred the same as tax-exempt?

Retirement accounts can be split into two categories, “tax-deferred” accounts and “tax-exempt” accounts. Both types are designed to minimize the amount of taxes you’re paying on your savings. The result is a big incentive for people to start their retirement accounts at an earlier age.

The difference between tax-deferred and tax-exempt is when those tax advantages really take effect.

Tax-deferred retirement accounts

Tax-deferred accounts provide the more immediate tax incentive. That’s because you can deduct the full amount of your contribution right away. But down the line, when you’re ready to use the money, the withdrawals are taxed at an ordinary income rate. (Your tax liability is “deferred” to a much later date).

The most common types of tax-deferred accounts include 401(k)s and traditional IRAs.

Tax-exempt retirement accounts

Tax-exempt accounts do not offer the same tax-deductible contributions as tax-deferred accounts. The contributions are made with after-tax money, so the savings are not as immediate. However, withdrawals from a tax-exempt account are not subject to taxes in retirement.

The most common types of tax-exempt accounts include the Roth IRA and the Roth 401(k).

What’s the best tax-deferred retirement account?

The single most important factor in choosing a tax-deferred investment strategy is your current and future tax brackets. You need to know what your income tax liability is on the day you open the account, as well as 20 or 30 years down the line when you’re ready to withdraw.

This is where your Personal Benefits Manager comes in. Working with a free advisor can shed a lot of light on which type of account is best for you.

IRAs: Individual retirement accounts

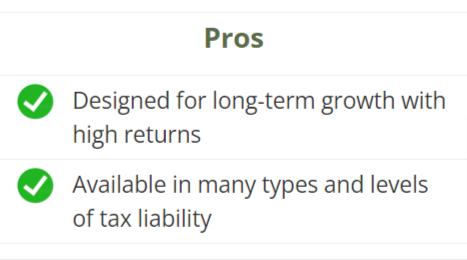

The Individual Retirement Account is one of the most commonly used forms of retirement investing. IRAs come in a lot of forms, including ROTH, SEP, and SIMPLE IRAs. But in all these forms, the IRA is designed to incentivize early contributions and long-term growth.

IRAs are popular because of their flexibility. They can be set up to invest in bonds, stocks, ETS, mutual funds, and a wide range of other assets.

Self-directed IRAs provide even more flexibility and an even broader range of investments. Roth IRAs give the option of contributing with after-tax dollars, allowing retirement withdrawals to be tax free.

IRA average annual return: 5%-10%

IRA maximum contribution amount: $6,000 ($7,000 if you’re over 50)

Pros |

Cons |

|---|---|

401ks: Employer-sponsored retirement accounts

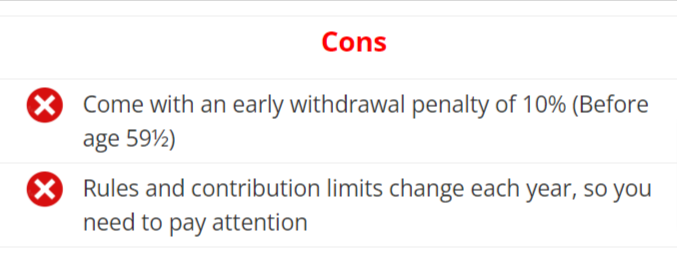

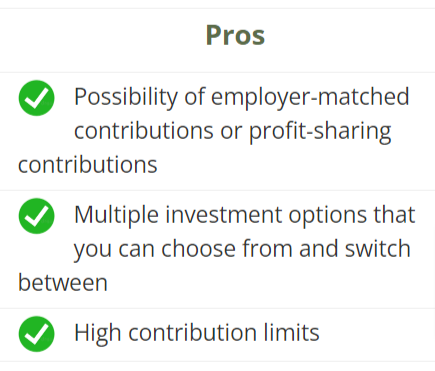

The 401(k) is a very popular form of employment benefit. These plans allow both the employer and the employee to take advantage of big tax deductions on all contributions. All contributions are made with pre-tax dollars, and are simply deducted from payroll.

Like IRAs, it’s possible to set up your 401(k) to invest in different things, like bonds, stocks, mutual funds, and other assets. All gains, dividends, and interest are not taxed until it’s time for a withdrawal.

Since 2006, a lot of employers also offer Roth 401(k) contributions. This gives the employee the option of making after-tax contributions instead of pre-tax contributions. The advantage is not having to pay tax on the withdrawal in retirement, but the actual savings depend highly on your tax brackets.

401(k) average annual return: 5% – 8%

401(k) maximum contribution amount: Salary and plan dependent, with a federal maximum of $19,500 (2021)

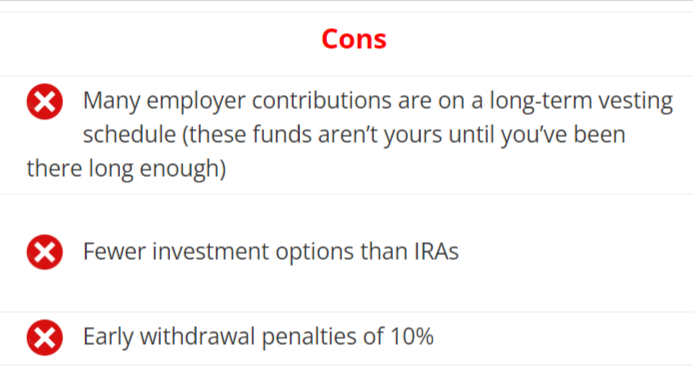

Pros |

Cons |

|---|---|

Health Savings Accounts (HSAs)

The Health Savings Account (HSA) is the only investment vehicle that offers both tax-free contributions and tax-free withdrawals. The only stipulations are a.) That the withdrawals need to be used for “qualified medical expenses” in order to remain tax-free, and b.) You must be enrolled in a high-deductible, HSA-qualified health insurance plan.

One of the big advantages is that the list of “qualified medical expenses” is actually pretty big. There are the more obvious costs, like premiums and deductibles. But beyond that, your HSA can pay for hearing care, prescription glasses, LASIK surgery, and even common over-the-counter (OTC) medicines.

When you consider the average cost of healthcare in retirement (about $300,000 for a couple retiring in 2021) it makes sense to dedicate a whole investment vehicle to this purpose.

HSA average annual return: 2.5%

HSA maximum contribution amount: $3,600 (individual) $7,200 (family)

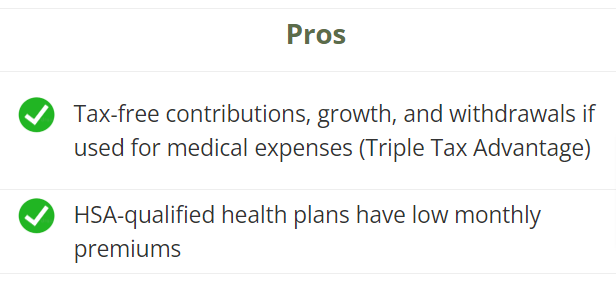

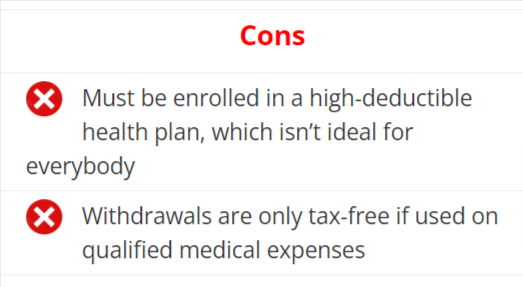

Pros |

Cons |

|---|---|

Our advisors can help you build a better retirement

There is no one-size-fits-all investment strategy that is guaranteed to make you rich. Setting up your retirement accounts requires some thoughtful strategy in order to maximize gains and minimize tax liability.

With a quick phone call, you can get setup a free, no-obligation consultation with one of our expert retirement advisors. We can help you understand the relationship between your tax bracket, your healthcare needs, and your long-term retirement plans.

We won’t choose a plan for you, and we’ll never push you into something that isn’t a good match. But you’ll walk away with the confidence that your retirement savings are working as hard as they can.

Call 800-913-6381 to schedule a consultation.

To Your Health and Wealth,

Wiley P. Long III

President- ColoHealth

The ColoHealth Health & Wealth Newsletter is published monthly and emailed to subscribers at no charge. Subscribe now to stay on top of the critical information you need to know about health insurance, healthshare plans and managing your finances to achieve financial security.

© 2021 | Legal Information