How to Apply for Coverage on the Connect for Health Colorado Marketplace

How to Apply for a Health Insurance Plan and Advance Premium Tax Credits on the Connect for Health Colorado

Colohealth Personal Benefits Managers are certified by the Connect for Health Colorado marketplace to help you to purchase your plan and apply for advance premium tax credits. We can help you to understand what pitfalls to watch out for. We’re here to help you find the plan that’s right for your unique needs and budget!

ALERT! Don’t Skip the Most Important Part of the Connect for Health Colorado Process!

You must authorize Colohealth as your agent after you create your profile in order to get the help you need — whether you are applying for an advance premium tax credit or simply browsing plans for enrollment. Get the simple, yet critical, steps here.

Getting Started: Determine Your Household Size

Depending on the size of your household and its income level, you may be eligible for Medicaid or for special federal subsidies called advance premium tax credits. These are determined by the size of your household and your household’s estimated income for the upcoming year.

Depending on the size of your household and its income level, you may be eligible for Medicaid or for special federal subsidies called advance premium tax credits. These are determined by the size of your household and your household’s estimated income for the upcoming year.

When determining your household size, count yourself, your spouse or unmarried partner needing insurance, and any children who live with you (even if they make enough money to file a tax return themselves).

Estimating Your Income for the Upcoming Year

Next, determine your household income. This includes total income for all people living in your household, including income earned by any dependents in your household who earn enough to file a tax return. Keep in mind that married couples must file jointly in order to qualify for an advance premium tax credit.

Next, determine your household income. This includes total income for all people living in your household, including income earned by any dependents in your household who earn enough to file a tax return. Keep in mind that married couples must file jointly in order to qualify for an advance premium tax credit.

The federal government uses your modified adjusted gross income (MAGI) for purposes of calculating premium tax credits. For most people, their MAGI is similar to their adjusted gross income (AGI). Remember to try to be as accurate as possible, as there will be a reconciliation of the advance premium tax credit when you file your income taxes in the following year.

Some people, especially those who are self-employed, may find it difficult to accurately estimate their income. Income can wind up being higher or lower than estimated, and if that happens you’ll need to call the Connect for Health Colorado customer service line at the end of the year to have your premium subsidy adjusted.

Figuring Out Advance Premium Tax Credit Eligibility

Once you’ve determined your household size and income, you’re ready to determine if you are eligible for Medicaid or premium tax credits.

Once you’ve determined your household size and income, you’re ready to determine if you are eligible for Medicaid or premium tax credits.

Every year the Center for Health and Human Services determines what the Federal Poverty Limit (FPL) will be for the upcoming year. You can find a table listing the FPL for individuals and families here, on the federal government’s healthcare website.

If your income is below 133 percent of the federal poverty level (FPL), you qualify for Medicaid. As a results of the ACA the eligibility requirements for Medicaid have broadened as far as who qualifies.

If your income is between 133 and 400 percent of the FPL, you’ll qualify for a premium tax credit. If your income is between 133 and 250 percent of the FPL, you are also eligible to apply for a cost-sharing tax credit (for ACA Silver plans only).

If your income is above 400 percent of the FPL, you will not be eligible for a premium subsidy tax credit, but you can still use the Connect for Health Colorado marketplace website to get your insurance plan. If this is your situation, you can skip the advance tax credit application page and go directly to choosing the health plan you like.

The Connect for Health Colorado marketplace exchange is the only place you can get an advance premium tax credit. But you can get a health insurance plan without applying for the subsidy if you don’t qualify or don’t want to apply now for a tax credit.

Get Started With Your Application

The next step is to complete your eligibility for an advance premium tax credit. This process is required if you think you may qualify for Medicaid or a premium tax credit.

The next step is to complete your eligibility for an advance premium tax credit. This process is required if you think you may qualify for Medicaid or a premium tax credit.

You can skip this step if you think you won’t qualify for a premium tax credit or Medicaid assistance or if you don’t want to go through the process of applying for the advance premium tax credit at this time.

If you want to skip this step (which takes about an hour to complete), you can still apply for a health plan and apply for the tax credit subsidy when you file your taxes.

Note that if you apply for an advance premium credit now, you’ll immediately get the reduced rate for your monthly premiums if you qualify.

Applying for an Advance Premium Tax Credit

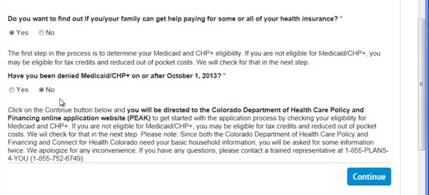

Log in to your account profile and select the “agree to privacy” button. This will take you to the “Do I qualify for financial assistance?” page. When visiting this page for the first time, you have not been denied for Medicaid or CHP Plus , and need to select the “No” button under “Have you been denied for Medicaid?” to continue to the PEAK system.

You’ll then create a new account and apply for Medicaid. Whether or not you qualify for Medicaid, you have to complete this step to get to the advance premium tax credit application.

Get Your Medicaid Denial Number

This step takes about an hour. 80 percent of applicants will get a denial the same day, while others will get a denial in a couple of days. The site will warn you that it could take up to 45 days. The denial, which is a seven-digit Medicaid denial code, will be used when you go back to apply for your advance premium tax credit. When you get your seven-digit Medicaid denial code number, you’ll go back to your account page and go through the “Do I qualify” process again. This time, answer “yes” and enter your seven-digit denial number.

This step takes about an hour. 80 percent of applicants will get a denial the same day, while others will get a denial in a couple of days. The site will warn you that it could take up to 45 days. The denial, which is a seven-digit Medicaid denial code, will be used when you go back to apply for your advance premium tax credit. When you get your seven-digit Medicaid denial code number, you’ll go back to your account page and go through the “Do I qualify” process again. This time, answer “yes” and enter your seven-digit denial number.

Go on to complete the eligibility application for advance premium tax credit. This takes about 20 minutes. At the conclusion, you can browse insurance plans to see the net cost minus your approved advance premium tax credit.

Here’s an example: If a plan costs $400 per month and your advance premium tax credit is $100 per month, your net cost will be $300 per month for your premium. Don’t forget to look at the “Silver” plans to see if you qualify for a cost-sharing subsidy; this will give you lower deductibles and out-of-pocket maximum costs when your household income is between 133 and 250 percent of the FPL.

How to Browse Plans

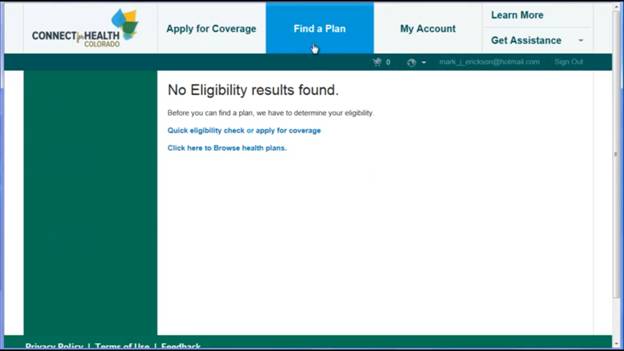

✓ Start your search for a plan by clicking on “Find a Plan” and then select “Click here to Browse health plans.”

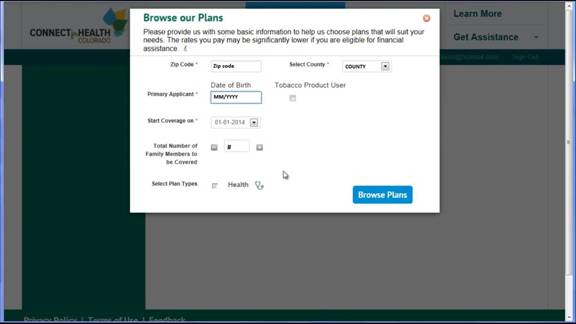

✓ Click “Browse Plans.”

✓ The system will “default” to show the lowest-priced plans with the highest deductibles.

✓ Filters on the left side let you sort plans by monthly premium, deductibles, out-of-pocket maximums and insurance carrier.

✓ The Metro Denver list is larger than other areas in Colorado.

The quality of benefits and costs vary by the metal plans of Platinum, Gold, Silver and Bronze, with premiums increasing in cost from Bronze (lowest) to Platinum (highest); deductible amounts, copays and out-of-pocket expenses will also vary based on metal plan.

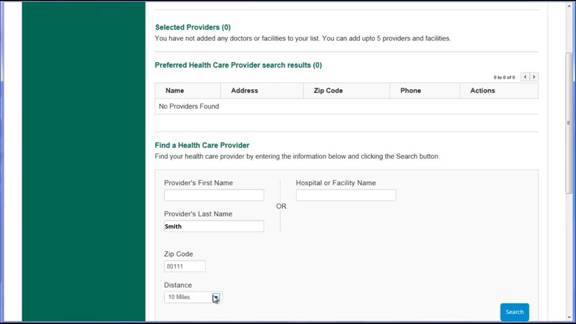

Check Your Provider’s Network Status

Although the names of insurance carriers may be familiar to you, you should not assume that the provider networks for these are the same as you’ve experienced previously. Many networks on the marketplace are smaller than in the past.

You can use the “doctor look-up” feature to see if your preferred doctor is in the network for the plan you’re considering.

Just choose the doctor by last name, zip code and mile radius to see the name you’re looking for. Select your doctor and you will see what network he or she is connected to by returning to “plans.” The system should filter in the provider networks associated with this doctor.

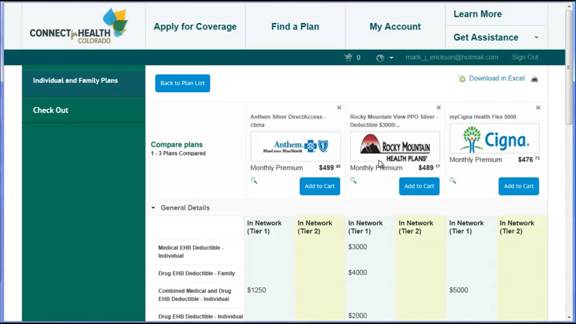

Comparing Plans

When comparing annual premium costs, keep in mind that “Bronze” plans have a maximum on their costs, including deductibles and copays per year.

You can apply a filter for “Silver” plans. Look at deductibles as well as maximum annual costs. Select boxes to compare up to three plan options side by side.

You can compare monthly premiums, deductibles, out-of-pocket maximums, copayments, and prescription drug coverage for generic or brand drugs. You should review these costs for any plan you are considering so that you are not surprised with an unexpected bill after going to the doctor.

Also check out facilities and coverage for inpatient surgery or outpatient services. Some have copayments for urgent care on nights and weekends.

When you’re ready to purchase a plan, add it to your cart and check out.

Work With Your Certified Colohealth Personal Benefits Manager

We encourage you to work with your Colohealth Personal Benefits Manager to avoid any pitfalls or mistakes in the enrollment process that could cause delays or added expense later on. It’s easy to protect yourself with our expertise with a few simple authorization steps!

Our Colohealth Personal Benefits Managers are ready to help you find the plan that’s right for you and your family. Call us today at (800) 913-6381!

Health Insurance Instant Quote

HEALTH INSURANCE INFORMATION

- Plans approved and authorized under the Affordable Care Act

- Covers Pre-Existing conditions

- Low cost subsidized plans available to those earning

< 400% of the federal poverty level - Unlimited lifetime benefits

- Available during open enrollment (November 1 – January 15), or if you qualify for a Special Enrollment Period

Healthshare Instant Quote

HEALTH COST-SHARING INFORMATION

- Not health insurance, but a way for like-minded individuals to share medical expenses

- Waiting periods on pre-existing conditions

- May exclude sharing for certain conditions or activities

- Enroll any time

- Much lower monthly cost than unsubsidized health insurance