Lots of people have access to an HSA account, but don’t get the full value out of these amazing wealth accumulation vehicles.

How to Get the Most Out of Your HSA Account

Why? They make these four common Hsa account mistakes:

- They don’t contribute enough – effectively wasting the opportunity.

- They don’t use their HSA to pay for qualified medical expenses. HSA funds can be used for a wide range of medical expenses, including doctor’s visits, prescriptions, hospital stays, some preventive care, and even for medically necessary vehicle and home modifications.

- They leave their HSA assets in cash for years and years, rather than take a bit of risk in the expectation of greater returns over time. This strategy usually doesn’t even up with inflation.

- Finally, some people open HSAs, or have an employer open one on their behalf – and forget they have them entirely. Again, overpaying for both taxes and healthcare, and letting the HSA opportunity go to waste.

By contributing the maximum you possibly can, using your HSA for the purpose intended, and taking advantage of self-directed HSA investing strategies, you can save or accumulate many thousands of dollars between now and retirement.

You just have to make use of the tools the tax code allows, and be patient.

Why Are HSA Accounts So Valuable?

Let’s take a moment to review why health savings accounts are such a powerful tax savings and wealth accumulation tool.

These accounts deliver unparalleled tax advantages in four basic ways:

- Tax-Deductible Contributions. The money you contribute to your HSA is tax-deductible, meaning you can reduce your taxable income by the amount you contribute. This reduces the amount of income that is subject to taxation.

- Tax-Free Growth. Any interest or investment earnings on the funds in your HSA grow tax-free. This allows your investments to grow faster since you do not have to pay taxes on the earnings.

- Tax-Free Withdrawals. When you use the funds in your HSA for qualified healthcare expenses, the withdrawals are tax-free. This means you do not have to pay taxes on the money you use for medical costs.

- Growth as a Retirement Asset. You can use any funds you don’t need for healthcare expenses to supplement your retirement with no penalties after the age of 65. (All you have to do is pay income taxes on your withdrawals.)

No other type of account can match this tremendous set of tax benefits.

FREE QUOTE

FREE QUOTE

COLORADO HEALTH INSURANCE

Why Are HSA Accounts So Popular?

There are a lot of reasons why people love HSAs so much.

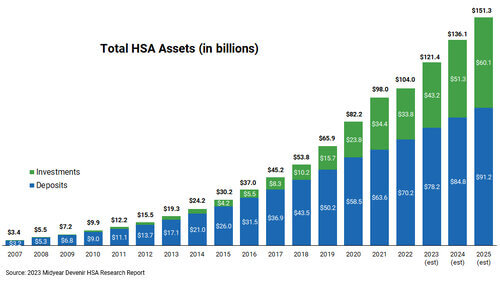

According to Devinr, nearly 36 million people have health savings accounts, collectively holding some $116 billion in assets.

That’s up quite a bit from their humble beginnings in 2007!

This consistent upward trend in HSA balances demonstrates how beneficial these plans can be for both health management and financial planning purposes.

HSA Accounts Have No Income Restrictions

Unlike IRAs and other similar retirement accounts, HSAs have no income caps on contribution eligibility. You can contribute the annual maximum to your HSA, no matter how much money you make.

The higher your income, the more valuable the HSA becomes, because as your tax bracket gets higher, the value of the tax breaks the HSA represents

Portability

HSAs are portable.

That means you can take them with you when you leave your job.

This is a huge advantage over Flexible Spending Accounts (FSAs), which require you to forfeit the money when you leave your employer.

Additionally, new laws now allow HSA funds to cover expenses like over-the-counter medications and feminine hygiene products.

Flexibility: You Remain in Control

HSAs also help you keep control over your own money and how you use it.

For example, you can use your HSA to escape narrow PPO, EPO, or PPO networks and see any doctor or use any hospital you choose.

You are in control, not your insurance company!

How to Get the Most Out of Your HSA Account

1. Get an HSA-Eligible Health Plan

There are two options for opening a HSA: you must either be enrolled in a qualified HDHP, or you may be eligible to enroll in the HSA MEC plan.

Let’s take a closer look at both options.

High Deductible Health Plan (HDHP)

HDHPs are a type of health insurance plan that have the following features:

- Higher Deductibles – Deductibles are typically higher than for other more traditional insurance plans, so that means you’ll have to pay more before your insurance kicks in to cover expenses.

- Lower Premiums – Conversely, the monthly premium is typically lower than other plans, so they can be a more affordable option for those who don’t have ongoing medical needs.

- Out-of-Pocket Maximums – They do include an out-of-pocket limit and once you’ve paid this amount within a year, the plan will cover 100% of all other eligible expenses.

- Preventative Care – Preventative care, such as screenings and vaccinations, are usually provided under the plan even if you haven’t yet met the deductible.

If you are in good general health and don’t need a doctor very often, a HDHP can be a great choice. You can contribute the savings pre-tax into your HSA.

As long as you are using this money for qualified healthcare expenditures, there’s no penalty for making withdrawals!

*It should be noted that withdrawing this money for anything other than healthcare expenses under the age of 65 will require you to pay income taxes on the amount you withdraw, as well as a 20% penalty. After age 65 the 20% penalty for nonqualified withdrawals goes away. You just pay income tax on the amount withdrawn, just as you would with a 401(k).

Additional Eligibility Requirements

To be eligible for an HSA, there are a few additional requirements beyond being covered by an HDHP or the HSA MEC plan that should be noted:

- You aren’t covered by another plan such as Medicare, Medicaid, TRICARE, or TRICARE For Life.

- You haven’t used VA health benefits within the last three months (other than for screening or disregarded services.).

- You’re not eligible to be claimed as a dependent on someone else’s tax return.

But if none of the above applies to you, then what are you waiting for? Get your HSA started!

2. Contribute!

Now that you’ve got your HSA set up and ready to go, start putting in as much money as possible!

HSAs allow you to save money without restrictions based on your income. This is particularly important for those in higher tax brackets, as contributing to an HSA will reduce your taxable income.

Every dollar you put into your account is a dollar less of income you need to pay tax on.

If you’re over the age of 55, you can contribute an additional $1,000.

As an added bonus, these contributions are considered an “above-the-line” deduction. You can take the standard deduction, and don’t have to itemize.

3. Invest

HSAs don’t limit you to the anemic returns of cash and money market accounts.

Yes, these are safe and stable. But in the long run, they typically don’t keep up with inflation.

If you’re in good health and willing to take a little more risk, you may be able to get a better return over time by investing your HSA in assets such as stocks, bonds, and mutual funds.

Note: It’s a good idea to spread your investments across multiple asset classes, as this tends to yield the best results over time. And, it’s always a good idea to keep a little cash available in case you need to withdraw some to cover medical expenses.

Keep in mind there may be fees involved, such as account maintenance and investment fees. So you may want to talk to a qualified investment professional for more personalized advice.

4. Be Patient

There’s no deadline or law that says your distributions need to be taken in the same year as the medical expense.

Save all your invoices and receipts. But consider using other money to pay those healthcare bills at the time. Then just leave the money in your HSA to accumulate tax-deferred as long as you can.

The longer your money stays in your HSA account accumulating, the more you’ll have later as a retirement asset. There are no required distributions like traditional IRAs. You can let your HSA compound even past age 72 and as long as you live, if you like.

For example: you could pay $5,000 for your child’s orthodontic work. Then years later, when you may be in a much higher tax bracket, you can withdraw $5,000 from the HSA. tax-free, and spend it on other costs, such as college tuition, or other retirement costs.

If the IRS wants to challenge your transaction, well, that’s why you kept your receipts!

Generally, when assets are growing tax deferred, you should be in no hurry to withdraw them and pay taxes on the income. Be patient, and let your HSA money compound for as long as you can.

The flexibility of this account is one of its greatest advantages!

5. Use Your HSA Account to Buy OTC Medications

Prior to 2020, you could not use an HSA to buy over-the-counter (OTC) medications.

But the CARES Act of 2020 included provisions that now allow HSAs to cover OTC medications and feminine hygiene products.

You can find a detailed list of everything that is considered an eligible expense in the IRS Publication 502.

Business Owners and Independent Contractors: Now You can Combine Health Sharing and an HSA Account!

Health sharing plans are an affordable alternative to traditional insurance.

The monthly costs are typically about 50% less than the cost of unsubsidized health insurance. But they can be great options for people who are in good health and don’t have any pre-existing conditions. Especially if you don’t qualify for an Obamacare subsidy!

Health sharing plans are also much better than traditional health insurance at letting you choose your own doctors and providers.

On their own, health sharing plans are not compatible with HSA accounts because they are not considered insurance products. However, there’s an excellent workaround that’s easy and affordable for anyone who is self-employed or owns their own business: add HSA MEC to a health sharing plan!

FREE QUOTE

FREE QUOTE

COLORADO COST-SHARING

How It Works

HSA MEC provides a Minimum Essential Coverage insurance plan that is specifically designed to provide the basic qualifications to contribute to an HSA at the lowest possible monthly cost.

This program is a win-win for people looking to combine all the benefits of health sharing with the benefits of an HSA.

To learn more, contact a Personal Benefits Manager and get started with your savings right away!

The Value of HSA Accounts

HSA’s are an excellent way to save for medical expenses on a pre-tax basis.

Contributions reduce your taxable income, the earnings grow tax-free, and withdrawals for qualified medical expenses aren’t taxed.

Are you ready to take control of your own healthcare expenses?

Contact a Personal Benefits Manager today to find the best HSA-compatible health plan for your Colorado lifestyle. And don’t forget to ask about the HSA MEC and health sharing options!

For Further Reading: “How to” Guide to HSAs | Coloradans, Concierge Medicine and HSAs: A Winning Combination! | Is There a Way to Pair a Healthshare Plan with an HSA? | HSAs – An Underrated But Powerful Retirement Asset

Leslie Alford is a Personal Benefits Manager at ColoHealth. Her aim is to help you make smart and informed healthcare coverage decisions that will fit your needs and budget. Read more about Leslie on her Bio page.